A new study from the Taub Center introduces an innovative tool (already in use in many countries around the world) for the economic and fiscal assessment of demographic changes — National Transfer Accounts (NTA). This tool bridges economics and demography. It calculates how people of different ages contribute, spend, and transfer money to each other — between generations or age groups — both privately and publicly. In doing so, it helps analysts understand how the balance between income and expenditure changes throughout the life cycle. According to the study’s authors, Professor Alex Weinreb, Kyrill Shraberman, and Professor Avi Weiss, the NTA can help policy makers shape social and economic policy that takes into account expected demographic shifts within and across Israel’s various population groups.

In recent years, the methodology has been expanded to allow analysts to identify NTA measures across population categories — for example, by gender or educational level. Thus far, Taub Center researchers have focused on the differences between Israel and other OECD countries and the differences between Israel’s three main population groups: Haredim, non-Haredi Jews, and Arabs.

NTA basics

The NTA is designed to cover the entire life cycle, from birth to death, taking into account the fact that people of all ages produce, consume, transfer, and save. In fact, it is an accounting framework that extends the standard national accounts system by adding age-based breakdowns. This allows us to identify when, throughout life, a person consumes more than they produce (for example, in childhood or old age) and vice versa. Additionally, as mentioned, it is possible to assess the fiscal contribution of different population groups not only by tax payments but also by transfers such as allowances, education and healthcare services, and family transfers.

Why is it relevant for us?

In an era of rapidly aging populations, changes in the labor market and welfare system, and differential growth among the groups that make up the population, Israel cannot afford to rely solely on traditional macroeconomic accounting. By combining micro-level data of individuals with macro-level data (national accounts), the NTA not only quantifies the deficits in individuals’ life cycles but also identifies their sources — whether through taxes, savings, or private and intergenerational transfers. In Israel, this tool is particularly vital due to the country’s unique characteristics: its young population; its high dependency ratio (the ratio between the working-age population and the young and elderly populations who are not of working age) compared to other OECD countries; the significant gaps between population groups in employment rates and education levels; and the rapid growth of groups with a challenging fiscal profile. All these factors lead to a high aggregate life-cycle deficit relative to GDP, creating long-term economic and fiscal challenges. Through the NTA, it is possible to model what will happen to tax revenues and government expenditures in the coming decades, thereby creating long-term macroeconomic forecasts grounded in both economic and demographic estimates for planning policy alternatives in education, healthcare, taxation, and more.

Uses of NTA worldwide

Due to its analytical power, NTA measures can now be found in many reports from the World Bank, the International Monetary Fund, and the United Nations Population Division. Partial NTA estimates already exist for over 100 countries, including nearly all OECD countries, with full estimates available for many subgroups within these countries. In contrast, such estimates are not available for Israel, which is unfortunate, especially given its unique economic and demographic profile.

Countries using the NTA calculate, among other things, how much of their citizens’ consumption is funded by taxes they currently pay, how much is funded by public versus private intergenerational transfers — a ratio that impacts future national debt — and what is likely to happen to these estimates given anticipated shifts in population size and composition.

What can we expect in the future? Projections until 2050

The Taub Center’s NTA projections for Israel are based, among other factors, on the expected aging and “Haredization” of the population: the share of those aged 70 and over in the population will increase from 8.2% today to 11.2% by 2050, and the proportion of Haredim in the population will rise from about 12.5% today to 20.5% by 2050. These changes will lead to two main outcomes:

- The burden on economically productive ages and groups will increase, and the reliance on public intergenerational transfers will strengthen.

- Arabs and Haredim will slightly improve their fiscal support ratio (the ratio of tax payments to consumption of services) from its current low level, but for non-Haredi Jews — the only group currently financing almost all of its own consumption — a sharp decline in this ratio is expected due to their faster aging.

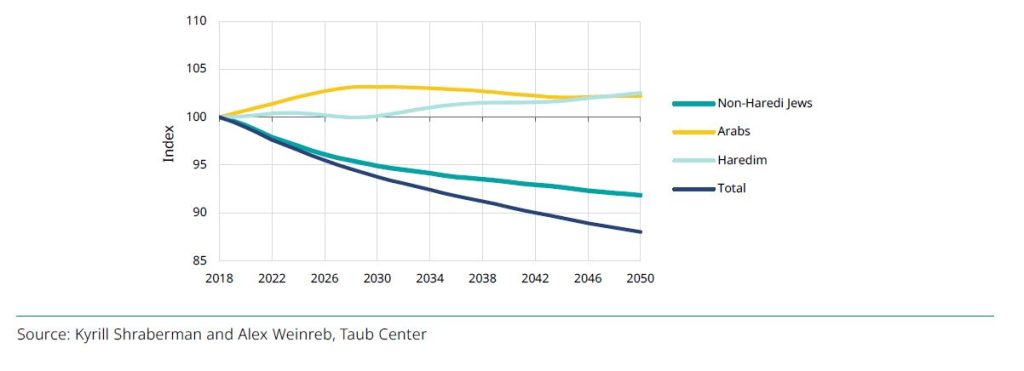

It appears, therefore, that unless the dependence of Israel’s two poorest populations, the Haredim and Arabs, on public transfers decreases significantly, Israel’s overall fiscal support ratio will decline by 12% by 2050. NTA calculations show that under current economic conditions, the aging population will exacerbate the impact of the fiscal support ratio of Arabs and Haredim on the Israeli economy.

Projected Fiscal Support ratios, 2018-2050, by subpopulation

According to the researchers, the major advantage of the NTA method is that the estimates it generates can help identify the areas where intervention through policy will yield the greatest benefit. If we wish to maintain fiscal balance, economic security, and quality public services in the future, active policy is needed to increase employment rates among disadvantaged groups in Israel, particularly among Haredi men and Arab women.

Professor Alex Weinreb, one of the study’s authors, says: “The State of Israel is unique among high-income countries: it has a unique age structure, distinctive life-cycle characteristics such as compulsory military service, and an exceptional population composition that includes groups with deliberately low labor market participation rates, contributing much less to the public coffers than they receive. The NTA is a comprehensive tool that allows for the integration of all these components in long-term planning. Given the expected economic and demographic changes in Israel, it is important that policy makers become familiar with this tool and make use of it.”

Kyrill Shraberman, another author of the study, adds: “Today, the issue of human capital plays a much larger role in discussions about economic growth. Compared to other analytical tools, the NTA better connects macroeconomics with human capital — that is, with the people themselves. The ability to see how economic activity changes throughout life and where resources come from gives additional meaning to the term mutual responsibility — both at the private family level and, more importantly, at the level of society as a whole.”

Professor Avi Weiss, the study’s third author, says: “The uniqueness of the NTA lies in its ability to analyze, among other things, how demographic and economic changes — such as changes in fertility rates, education quality, labor force participation rates, retirement age, taxation, and more — will affect the long-term reality. Therefore, this tool is essential for decision makers who have the well-being of the population in Israel at the forefront of their priorities.”

For additional information and to confirm your place, please contact Chen Mashiach, Taub Center spokesperson: 054-7602151, or by email: chenm@taubcenter.org.il