A study by Taub Center Executive Director, Prof. Dan-Ben David, and Taub Center researcher Haim Bleikh in the State of the Nation Report 2013 unveiled the depth of challenges Israel faces with regards to inequality.

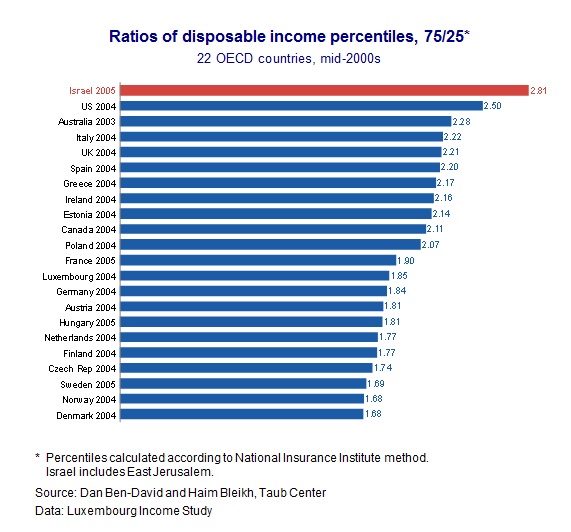

In comparison to 22 OECD countries, Israel is second only to the United States in terms of disposable income inequality – that is, after government taxes and transfers. Israel does not perform much better when it comes to market income inequality (income before government taxes and transfers), coming in fifth highest among the 22 countries.

There are certain population groups – namely the Haredim (ultra-Orthodox Jews) and Arab Israelis – that are particularly afflicted by poverty. In 2011, 70 percent of Haredim and 57 percent of Arab Israelis lived under the market income poverty line. Even in terms of disposable income, 57 percent of Haredim and 50 percent of Arab Israelis still live under the poverty line. The low incomes of these populations greatly contribute to Israel’s high inequality levels. However, Ben-David and Bleikh stress that income inequality is not due to the existence of extensive poverty in these populations alone. As shown in the first figure, even after exclusion of these two groups from the sample, income inequality among non-Haredi Jews in Israel is still greater than the inequality in all of the developed countries sampled except the U.S. and the U.K.

Part of Israel’s challenge seems to be its relatively less effective government welfare system. For example, while the median OECD country is able to reduce inequality by 40 percent (as measured between market and disposable incomes) with taxes and welfare benefits, Israeli government involvement only reduces inequality by 25 percent. This is the second smallest reduction – following the United States – between market and disposable income inequality.

Much of the public focus in the inequality discourse, both within Israel and abroad, is on the very highest earners and high concentration of wealth at the top of the income distribution. Ben-David and Bleikh’s study shows, however, that in contrast to the conventional wisdom, this issue is not particularly unique in Israel. In terms of market income, Israel’s top 1 percentile earned 6.3 percent of total income in the country, which is a smaller share than in fourteen of the 22 OECD countries in the sample. In comparison, the highest earners in top-ranked Norway and bottom-ranked Spain accounted for 9.8 percent and 4.3 percent of all market income, respectively. In terms of disposable income, Israel’s top earners account for 5.3 percent of all income in the country, placing the country eighth out of the 22 OECD countries. This is substantially less than top-ranked Norway (8.8 percent) while noticeably higher than bottom-ranked Luxembourg (3.4 percent). In short, the share of total incomes going to Israel’s very wealthiest is not exceptional by developed world standards and this, too, is an insufficient explanation for Israel’s particularly high degree of income inequality.

A vivid example of how widespread income inequality is in Israel is provided by a look at the country’s middle class. Though there is no formal definition of the middle class, Ben-David and Bleikh examine income gaps among the non-wealthy and non-poor population. For example, the ratio of disposable income between an individual in the 90th percentile and one in the 50th percentile (i.e., the median) in Israel is 2.32. This ratio is higher in Israel than in all 22 OECD countries examined. Similarly, the ratio between an individual in the 50th percentile and one in the 10th percentile in Israel is 2.75. Here too, Israel tops the list in terms of the largest gap between the two.

Even when removing the extremes and focusing on what might be considered the lower and upper middle class (25th – 75th income percentile), the income gaps in Israel stand out. The income of an Israeli in the 75th percentile is 2.81 times that of an Israeli in the 25th percentile. This is a 12 percent larger ratio than that observed in the second-ranked country, the United States (at 2.50) and almost a quarter more than third-ranked Australia (at 2.28).

Ben-David and Bleikh help shed light and expand on the issue of income inequality in Israel. Their study explains that such inequality is not limited to certain population segments, and it is not due to very high concentrations of wealth at the top. Instead, extensive inequality exists across the entire spectrum between the 10th and 90th percentiles of the income distribution, and even more so within the middle 50 percent (i.e., between the 25th and 75th percentiles) of the income distribution. Israel stands out relative to 22 other OECD countries with regards to the large gaps across the income distribution, and public attention and policies need to address this very real social and economic issue.